Stephen M. Mills, CIMA® Partner

Chief Investment Strategist

Introduction

Although Santa Claus left a lump of coal for investors in the last trading week of 2024, both the U.S. economy and equities markets chalked up another year of gains. The economy was on pace to expand at an inflation-adjusted rate of just under 3% for 2024, according to recent year-end estimates for U.S. Gross Domestic Product (GDP).1The economy was supportive of stock prices as the S&P 500 Index achieved a second straight year of double-digit returns surging 25%, while the Dow Jones Industrial Average recorded a 15% total return.2The S&P 500 Index notched 57 record all-time highs during the year as the economy remained healthy, inflation and interest rates moved lower, and the technology-led rally continued.2

We began 2024 with a cautiously optimistic outlook for the U.S. economy and financial markets based on favorable monetary conditions, the overall financial health of U.S. consumers, and the resilience of the U.S. economy that continued to grow despite a few near-term economic headwinds. Our reasons for caution this time last year were concerns regarding continued geopolitical risks in both the Middle East and Ukraine, as well as the uncertainty around the presidential election. These risk factors ended up having little impact on U.S. economic growth or the stock market as the U.S. economy continued to grow modestly and the major U.S. stock market averages surged ahead.

We are again optimistic for continued economic growth and favorable equity markets in 2025. Our optimism is based on what we believe are strong fundamentals for the U.S. economy. We see GDP growth for the U.S. economy in the 2.5-3% range for 2025. Specifically, we see declining interest rates after the Federal Reserve began cutting rates in September of last year, the potential for job and wage growth, and a more pro-business environment in Washington after the November election as key factors supporting our positive economic growth in 2025. The increased levels of both business and consumer confidence since the election may be a reflection of these potential fundamental developments.

We believe the incoming Trump administration and the Republican control of both the House of Representatives and the Senate will usher in a wave of legislation that will benefit both businesses and consumers. Both the Trump administration and congressional leaders are looking to get off to a fast start and put in place legislation that will include: extending the 2017 tax cuts (which expire at the end of 2025), implementing broad-based regulatory reform, dealing with illegal immigration, and addressing the growing government budget deficit.

We see this pro-business agenda having a positive impact on the economy and the U.S equity markets, although, it will not be without growing pains. Lower taxes, less government interference in business, and the potential reduction of government deficit spending will encourage businesses to expand their operations, encourage foreign capital investment in the U.S. economy, and improve labor markets, in our view. We believe corporate earnings will benefit from these positive developments which in turn could help propel the U.S. stock markets higher in 2025.

For a more in-depth analysis of the economy and the financial markets, including our investment outlook and strategy, please read on.

U.S. Economy

The U.S. economy continued to show remarkable resilience in 2024 in spite of the headwinds the economy has faced over the last couple of years with rising interest rates, persistently high inflation, recession fears and a very controversial presidential election cycle. The higher interest rates alone would have normally thrown the economy into at least a mild recession. The U.S. Federal Reserve (Fed) aggressively raised interest rates in 2022 & 2023 to battle inflation before finally beginning to lower rates in September of this past year. The Fed’s aggressive monetary tightening paid off as inflation receded from the nearly 9% level in mid-2022 to the current level of about 2.7%, according to the November Consumer Price Index date released by the U.S Bureau of Labor Statistics.3One key element supporting the economy in our view, has been the strength of consumer spending. Since consumer spending accounts for approximately two-thirds of U.S. GDP, the economy was able to maintain a reasonable growth rate for 2024.

As the calendar turns to 2025, we remain optimistic that the U.S. economy will continue to grow at a moderate pace. The three primary conditions supporting our optimism include:

1. Continued Federal Reserve loosening of monetary conditions

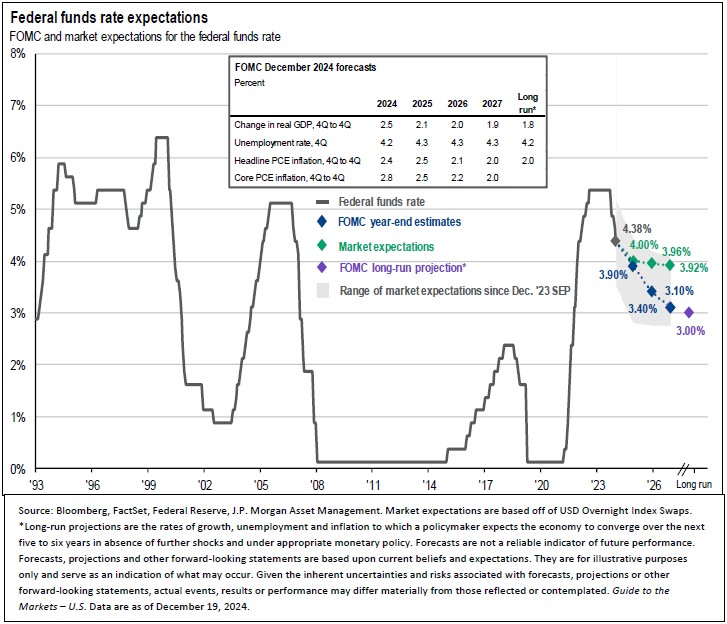

As we mentioned earlier, the Federal Reserve began to lower short-term interest rates in September 2024 through cutting the Fed funds rate by .50%.4They had previously raised the rate from a historic low of .25% in January 2022 to 5.25% by August 2023.4The Fed followed up the September rate cut with two more 25 basis point (.25%) cut rates at their November and December meetings, bringing the Fed funds rate down to the 4.25% to 4.5% range where it currently sits.4The Fed indicated in the December meeting that they would consider additional downward adjustments to the Fed funds rate based on future incoming data regarding inflation and economic growth.5The Fed has a mandate for an inflation rate in the 2% range while also maintaining a healthy labor market. The FOMC (Federal Open Markets Committee) that drives Fed policy, had year-end estimates of four rate cuts in 2025 while the Market expectations are for two additional rates cuts this year. The fact that the Fed has now pivoted from tapping the economic brakes through aggressive monetary tightening to now providing economic stimulus through lowering interest rates, is very positive for both the economy and the stock market, in our view. Lower interest rates are particularly important for businesses because as their cost of capital declines their profits potentially rise allowing them to more aggressively expand their operations.

2. Employment and wage growth for the labor market

Lower cost of capital for business should translate into more hiring of workers as companies expand their operations. Labor growth slowed in 2024 and the unemployment rate rose modestly as some businesses laid off workers to cut costs. However, we see this trend reversing in 2025 for several reasons including: lower interest rates, a more favorable business environment and an expansion of U.S. manufacturing after decades of decline. Wage growth has been strong for the past two years peaking at nearly a 7% annual growth rate in the first quarter of 2022.6Granted, some of that growth was due to the high inflation rate in the economy at the time however, wage growth has stayed above a 4% annual rate through November 2024, according to the Federal Reserve Bank of Atlanta Wage Growth Tracker.6We believe the combination of job gains and wage growth will continue to support strong consumer spending for 2025, which as we mentioned earlier, is a key component of U.S. GDP growth.

3. A more pro-business administration in Washington

As we mentioned earlier, we believe economic fundamentals will improve with the incoming Trump administration and the Republican control of both the House of Representatives and the Senate. The administration will push for legislation to extend the 2017 tax cuts and possibly even lower corporate and individual tax rates from current levels. We also believe the administration will seek broad-based regulatory reform to free up businesses from burdensome regulations that hamper productivity and drive up costs. Lower taxes and deregulation will provide incentives for companies to manufacture products in the U.S. instead of in foreign countries. These measures will also benefit consumers through keeping tax rates low and reducing prices, which is a byproduct of deregulation. Reduced regulation improves efficiency, reduces the cost of production, and lowers barriers of entry for small businesses. Deregulation often results in lower prices of goods and services. In addition, we believe the Trump administration will seek to reduce government spending which will help strengthen the U.S. government’s fiscal position and support the U.S dollar. A stronger U.S. fiscal position will potentially encourage foreign investment in the U.S. Although it will take a little time to get these pro-business and pro-consumer policies implemented, the long-term impact on the U.S. economy could be significant over the next few years.

These three factors support our optimistic view of the economy and the financial markets however, there are other reasons for our optimism including, improved business and consumer confidence, productivity gains from implementation of artificial intelligence applications, increased investment in the energy grid, and the overall attractiveness of the U.S. markets to foreign investors. We believe the U.S. will continue to outperform the rest of world and attract capital from both domestic investors as well as foreign investors for the next several years. To be sure, there will be potholes along the road of progress, but we see little on the horizon that could derail the economy.

Economic Risk Factors

Of course, there are risks to our view which we would be remiss not to mention. We still face geopolitical risks associated with the wars in the Middle East and Ukraine, such that if either were to escalate into a more regional war, it could have a negative impact on global economic activity. At this point, neither conflict appears to be widening. On the contrary, both may be closer to some sort of resolution and peace accord this year. It appears that Israel military operations have gained the upper hand in the war against both the Hamas in Gaza and the Hezbollah in Lebanon. Both terrorist groups have been severely weakened by the war and may move to seek an end to the fighting. In addition, the war in Ukraine appears to have reached a stalemate which could move both Russia and Ukraine to seek a negotiated peace soon. We believe the Trump administration will be very active in negotiating an end of the hostilities in both regions.

Another risk factor for the U.S. economy is the possibility of new tariffs imposed by the Trump administration on certain of our trading partners. Tariffs can be a double-edged sword. While they may punish a wayward trading partner, they can potentially hurt the economy by raising prices of imported goods and services and contributing to higher inflation. Aggressive new tariffs could also set off a trade war with other countries which could negatively impact the global economy. Trump has suggested that he will use tariffs to encourage fairer trading, curb illegal immigration, reduce fentanyl from coming into the U.S. and revitalize U.S. manufacturing. While Trump may achieve these goals over the long-term, in the short-term, we believe that increased tariffs are likely to at least create volatility and economic uncertainty.

Lastly, there is the possibility of a resurgence of inflation. Inflation has come down significantly since 2022 but still remains stubbornly above the Federal Reserve’s 2% goal at just under 3% on an annualized basis, as sited above. The combination of increased tariffs, lower taxes and continued government deficit spending could push inflation higher in 2025. Any surge in the monthly inflation statistics, could force the Federal Reserve to keep interest rates at what most economist view as a restrictive level or worse, influence the Fed board to raise interest rates at some point during the year. While we believe the prospect of higher inflation is low, we feel it is a risk that should be taken into consideration.

Equities

Although the stock market finished December on a negative note, 2024 was a strong year for the U.S. equities markets as the major stock market indices posted double-digit gains for the year. Lower interest rates and robust corporate earnings growth were the key drivers of stock prices in 2024, in our view. The Federal Reserve had indicated in its November meeting in 2023, that it may begin lowering short-term interest rates in 2024. This was a significant pivot away from its monetary tightening policy that had been in place since early 2022 and signaled to investors that the Fed was shifting into an easing mode for the next several quarters. Although the Fed waited until its September 2024 meeting to begin lowering the Fed funds rate, there was a positive reaction in the stock market almost immediately after the Fed’s November 2023 meeting which continued for most 2024. Investors generally view lower interest rates as a positive for the economy.

While the Fed was doing their part in supporting stock prices, corporate earnings continued to show strong growth for most S&P 500 companies. After posting a nearly flat year for earnings growth in 2023, S&P 500 earnings is estimated to have grown at 9.4% in 2024, according to research firm Factset.7 Factset estimates S&P 500 earnings will grow at nearly 15% for 2025, which is above the 10-year annual earnings growth rate of 8% (2014-2023)7 Earnings growth was concentrated in a small number of large company growth stocks in 2024. As we have noted in previous letters, the S&P 500 Index gains have largely come from what is referred to as the “Magnificent 7” companies and a few other technology stocks over the past two years. We anticipate a broadening of earnings growth in 2025 and believe that both earnings growth and market gains over the next couple of years will also come from other sectors of the stock market. Factset estimates that while the “Magificent 7” companies will grow earnings at 21% in 2025, they expect the rest of the 493 companies in the S&P 500 will report earnings growth of 13% in 2025 verses just 4% for 2024.

As we mentioned in our July 2024 TCM Investment Outlook & Strategy letter, we believe a new bull market in stocks began in the fall of 2022 when the S&P 500 Index bottomed with a peak-to-trough decline of 27% from January 7, 2022 to October 13, 2022.8 From that October low, the S&P 500 has gained 68% as of December 31, 2024, not including dividends.2 The average bull market since January 1, 1926 has gained 220% and lasted 4.9 years according to a joint Bloomberg and Wells Fargo Investment Institute study.9 While past performance is no guarantee of future results, we feel there is potentially more upside for this current bull market in equities that could propel the major averages higher over the next 12-18 months.

As we mentioned in our July 2024 TCM Investment Outlook & Strategy letter, we believe a new bull market in stocks began in the fall of 2022 when the S&P 500 Index bottomed with a peak-to-trough decline of 27% from January 7, 2022 to October 13, 2022.8 From that October low, the S&P 500 has gained 68% as of December 31, 2024, not including dividends.2 The average bull market since January 1, 1926 has gained 220% and lasted 4.9 years according to a joint Bloomberg and Wells Fargo Investment Institute study.9 While past performance is no guarantee of future results, we feel there is potentially more upside for this current bull market in equities that could propel the major averages higher over the next 12-18 months.

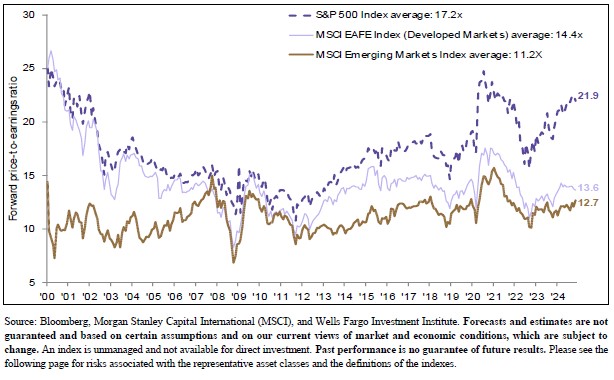

Some argue that after two straight years of 20% plus gains for the stock market that now is the time to be a little more cautious. As we mentioned earlier in the section on the economy, there are a few potential risks that could derail the bull market and support a more cautious investment posture. In addition, valuations for the overall market are above average as indicated in the chart on the left which shows the Price to Earnings ratios (P/E) for the S&P 500 Index as well as the MSCI EAFE and Emerging Markets indices. Currently, the P/E ratio for the S&P 500 is 21.9, as of November 30, based on Well Fargo Investment Institute’s estimate for Earnings Per Share. While this P/E ratio is above the historical average of 17.2, we believe that based on the potential earnings growth of the S&P 500 for 2025 as we mentioned above, it is a reasonable valuation and not a level that we are concerned about at this time.

Despite the risk factors mentioned above and the higher-than-normal market valuation, we are optimistic about a continuation of the bull market. However, we will almost certainly have corrections along the way. Corrections of 5% to 10% are normal in a Bull market trend as history has shown. On average, the S&P 500 Index has historically experienced a 10% correction at least once per year in our observation. Our last 10% correction was in the summer and fall of 2023 so we may be due for one in the near future.2Timing such corrections is very difficult so we recommend staying fully invested. However, when such a correction does occur, we recommend using it as a buying opportunity for those who are desiring to put cash to work in equities.

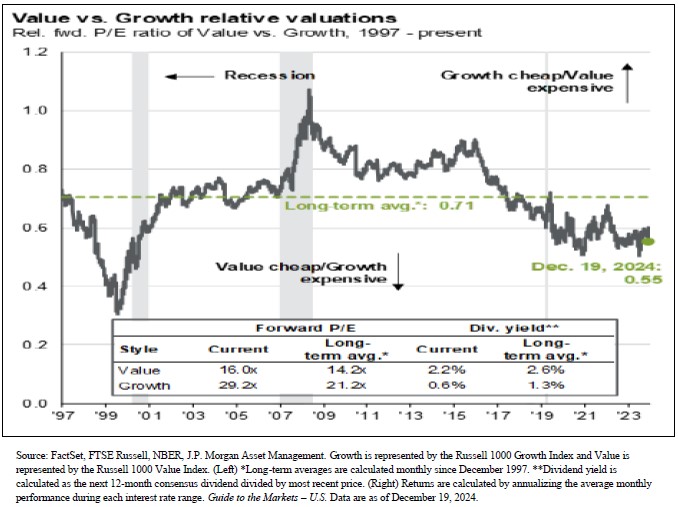

We continue to favor value stocks for conservative investors seeking both dividend yield and lower volatility. The chart on the right shows the relative valuations for value vs growth stocks. The green dotted line shows the average relative value over the past 25 years. When the solid black line is above the green dotted line growth stocks are cheap relative to value stocks. When the black line is below the green dotted line value stocks are cheap relative to growth stocks. We believe that over the next several years, value stocks will outperform growth stocks.

We continue to favor value stocks for conservative investors seeking both dividend yield and lower volatility. The chart on the right shows the relative valuations for value vs growth stocks. The green dotted line shows the average relative value over the past 25 years. When the solid black line is above the green dotted line growth stocks are cheap relative to value stocks. When the black line is below the green dotted line value stocks are cheap relative to growth stocks. We believe that over the next several years, value stocks will outperform growth stocks.

We continue to favor companies that have a history of raising their dividends each year as well as high dividend yielding stocks. (Dividends are not guaranteed and are subject to change or elimination.) We also believe there is opportunity in certain high-quality growth stocks, especially those involved in cloud computing, software and hardware development and artificial intelligence (AI) technologies. We believe there will be widespread adoption of AI across all industry groups over the next several years that will impact both businesses and consumers as more applications are developed. This will help drive the need for more data centers and both hardware and software applications to drive the massive compute requirements.

Small-cap stocks look attractive to us on a valuation basis and could finally for the first time in years, out-perform large and mid-cap stocks in 2025. Lower interest rates and economic growth in the U.S could positively impact smaller companies this year and perhaps over the next few years. We have been bearish on this area for the last few years but we think it may be time for this area of the market to shine.

We believe it will continue to be a challenging environment for international stocks which substantially under-performed U.S. markets in 2024.2Our economic outlook points to little or no growth for most foreign economies in 2024, particularly China and many European countries. At some point, we feel both developed and emerging markets will become attractive for investment however, we continue to believe that now is not the time to add exposure to these asset classes. A small exposure to international stocks may be appropriate for those investors seeking more portfolio diversification. However, we would wait to add additional exposure to this area until fundamentals improve.

Fixed Income

Fixed Income

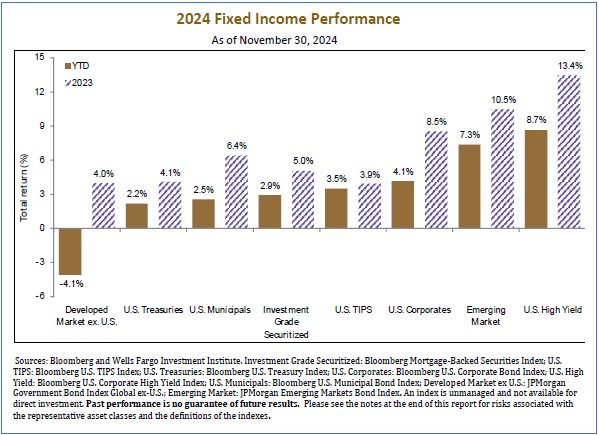

While the stock markets rewarded equity investors with attractive gains in 2024, the fixed income markets were not quite as generous. As you can see in the graph on the left, total rates of returns for most high-quality bond sectors ranged between 2.2% on the low end for U.S. Treasuries, to 4.1% on the high end for U.S. Corporates. We expect increased volatility in the fixed income space in 2025. We believe that fixed income yields will be range-bound and perhaps end the year a bit below current levels.

We continue to see good value for investors in the fixed-income markets. We believe that high-quality fixed income instruments provide historically attractive risk-adjusted returns for conservative investors at current levels. For investors seeking to generate income as well as for portfolio diversification purposes, we continue to favor U.S. Treasuries, high-grade corporate bonds, mortgage-backed securities, prime money market funds, and tax-free municipal bonds. Current interest rates for money funds and shorter-term securities, and yields on intermediate-to-long-term bonds are in the 4-5% range.2We view tax-free municipal bonds, with current yields ranging from 3% to 4% for intermediate and longer-term maturities, as very attractive for investors in higher tax brackets. Those tax-free yields calculate to a taxable equivalent yield for investors in a 40% tax bracket of 5% to 6.6%. Although prime money markets yields are still in the 4.5% range,2investors who are holding significant cash type instruments may want to consider locking in the current yields on intermediate fixed-income instruments. If inflation continues to trend lower and the Federal Reserve implements additional rate cuts this year, money funds yields will continue to decline. One wild card for the bond market would be if the Trump administration makes good on promises to reign in government spending resulting in lower budget deficits. We believe this would positively impact fixed income markets. Using the 10-year Treasury note as our benchmark which is currently yielding 4.6%, we see the range for the 10-year note over the next 12 months between 4% and 5%. We recommend that fixed income investors remain flexible with bond portfolios. For instance, you could extend maturities if the 10-year note yield rises to the upper end of the range from current levels, and shorten maturities if the 10-year note yield declines to the lower end of the range during the year.

Commodities:

The commodities market rebounded from a loss of 5.5% in 2023 to post a gain of 8.5% in 2024, as measured by the S&P GSCI Commodity Index (GSCI). In our 2024 January TCM Outlook and Strategy letter, we saw prices of most commodities stabilizing in the first half of the year but resuming their upward trend that began in 2020 in the second half of the year.8The GSCI was virtually flat from the beginning of January until September 11 but then over the last four months of the year gained a little over 8%. Through modern history, commodity prices have tended to move in long-term bull and bear cycles. We believe a new long-term bull market in commodities started in May 2020. Commodity bull cycles typically last 10-15 years, however, like the equity markets, they are subject to corrections along the way.

We continue to favor energy, copper, silver and agricultural commodities. We see long-term upside opportunity in both crude oil and natural gas as demand for energy resources increases with population growth, industrial expansion and increase use of data centers to drive cloud computing and AI applications. Supplies of both oil and natural gas have remained sufficient to meet demand over the past two years. However, we believe that over the next couple of years, supplies will diminish as demand grows. We continue to favor energy equities especially companies involved in both the production and transportation of oil and gas products. Dividend yields for many companies in these two sectors are well above the dividend rate for the S&P 500 which currently stands at 1.2%.2(Dividends are not guaranteed and are subject to change or elimination.) We also see demand for copper and silver rising with the expansion of the use of both solar and wind power to meet increasing energy demands as well as the continued adoption of the use of electric vehicles. These technologies use a great deal of both copper and silver in the manufacturing of these products. Both copper and silver face significant supply constraints over the next few years, according to our research. Lastly, we are bullish on agricultural commodities with positive demographic and industrialization trends in emerging economies driving higher demand for food, especially protein-based products.

The Bottom Line

It has been a prosperous couple of years for most equity investors as well as businesses and consumers. Equity markets are up significantly from the lows in 2022, the economy continues to grow moderately, and inflation has receded to more normal levels. We see many more positives than negatives for 2025 which we believe will help sustain economic growth and propel equity markets higher. However, with two back-to-back 15% plus gains for the major U.S. stock market averages, we believe gains for 2025 could be somewhat lower, perhaps more in the 7-10% range for equities, using the S&P 500 Index as our benchmark. Intermediate bonds and bond funds could provide a return in the 4-5% range in our view.

We see long-term developments like the rebuilding of U.S infrastructure, manufacturing reshoring from China and other foreign countries, and the implementation of robotics and AI technologies, driving capital investment for several years. We believe the U.S. will continue to have a competitive advantage over the rest of the world making it attractive for investors.

For most investors, we believe a portfolio that is balanced between stocks, bonds, and money funds is appropriate. We will inevitably see more volatility in the financial markets in 2025, so having exposure to fixed income and cash would potentially reduce overall portfolio volatility. Stock market corrections after a strong couple of years of strong gains are certainly a possibility during 2025 as we discussed. We would use any corrections to add to stocks, where appropriate.

We believe the beginning of the new year is a very good time to review your long-term investment goals and to evaluate your current asset allocation strategy and to make sure that your portfolio is in line with your goals and objectives. This could also be a good time to rebalance portfolios back to long-term asset allocation targets.

As we begin the new year, we are very grateful for all of our client relationships and for the confidence and trust you place in us. We are honored and blessed to serve you and your families and look forward to our continued relationship.

May you and your families have a very Happy and Prosperous New Year!

Your Trinity Capital Management Team

Website:www.tcmtx.com

TCM Tyler TX Location

821 ESE Loop 323, Suite 110

Tyler, Texas 75701

903-747-3960

Footnotes

1 Trading Economics https://tradingeconomics.com/united-states/gdp-growth

2 Thompson Charts

3 https://www.bls.gov/news.release/cpi.nr0.htm

4 https://fred.stlouisfed.org/series/FEDFUNDS

5 Wells Fargo Investment Institute, FOMC Meeting: Key Takeaways, December 18, 2024

6 https://www.atlantafed.org/chcs/wage-growth-tracker

7 Factset Earnings Insight, December 20, 2025. https://www.factset.com/earningsinsight

9 Wells Fargo Investment Institute Economic and Market Commentary, June 10, 2024

To view the above links, press and hold the Ctrl key on your keyboard, hover over the link and left click your mouse.

Investment products and services are offered through Wells Fargo Advisors Financial Network, LLC (WFAFN), Member SIPC, a registered broker-dealer and separate non-bank affiliate of Wells Fargo and Company. Trinity Capital Management, LLC is separate entity from WFAFN.

Stocks offer long-term growth potential, but may fluctuate more and provide less current income than other investments. An investment in the stock market should be made with an understanding of the risks associated with common stocks, including market fluctuations. Investing in foreign securities presents certain risks not associated with domestic investments, such as currency fluctuation, political and economic instability, and different accounting standards. This may result in greater share price volatility.

The opinions expressed in this report are those of the author(s) and are not necessarily those of Wells Fargo Advisors Financial Network or its affiliates. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy.

Wells Fargo Advisors Financial Network is not a legal or tax advisor. Consult your tax advisor or accountant for more details regarding your specific circumstance.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income securities may be worth less than the original cost upon redemption or maturity. Yields and market value will fluctuate so that your investment, if sold prior to maturity, may be worth more or less than its original cost. Bond prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment. Income from municipal securities is generally free from federal taxes and state taxes for residents of the issuing state. While the interest income is tax-free, capital gains, if any, will be subject to taxes. Income for some investors may be subject to the federal Alternative Minimum Tax (AMT).

The commodities markets are considered speculative, carry substantial risks, and have experienced periods of extreme volatility. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns nor can diversification guarantee profits in a declining market.

The Consumer Price Index (CPI) is a measure of the cost of goods purchased by average U.S. household. It is calculated by the U.S. government's Bureau of Labor Statistics.

P/E Ratio is a valuation of a company or an index’s current value compared to its earnings per share. It is calculated by dividing the market value per share by earnings per share.

S&P 500 Index: The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index with each stock's weight in the Index proportionate to its market value.

Bloomberg U.S. Corporate Bond Index includes publicly issued U.S. corporate and Yankee debentures and secured notes that meet specified maturity, liquidity, and quality requirements.

Bloomberg U.S. Corporate High Yield Bond Index covers the universe of fixed rate, non-investment grade debt.

Bloomberg U.S. Mortgage-Backed Securities Index measures the performance of investment grade fixed-rate mortgage-backed pass-through securities of GNMA, FNMA and FHLMC.

Bloomberg U.S. Municipal Bond Index covers the USD-denominated long-term tax-exempt bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds.

Bloomberg U.S. TIPS Index is an unmanaged market index comprised of all U.S. Treasury Inflation-Protected Securities rated investment grade, have at least one year to final maturity, and at least $500 million par amount outstanding.

Bloomberg U.S. Treasury Index measures the total return US dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury.

JPMorgan Emerging Markets Bond Index (EMBI Global) covers 27 emerging market countries. Included in the EMBI Global are U.S.-dollar-denominated Brady bonds, Eurobonds, traded loans, and local market debt instruments issued by sovereign and quasi-sovereign entities.

JPMorgan Government Bond Index Global ex-U.S. measures the performance of non-U.S. government bonds.

The S&P GSCI® is a composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities. The index consists of 24 commodities from all commodity sectors - energy products, industrial metals, agricultural products, livestock products and precious metals but its exposure to energy sector is much higher than other commodity price indices.

Index return information is provided for illustrative purposes only. Index returns do not represent investment performance or the results of actual trading. Index returns reflect general market results, assume the reinvestment of dividends and other distributions and do not reflect deduction for fees, expenses or taxes applicable to an actual investment. An index is unmanaged and not available for direct investment.

Past performance is no guarantee of future results and there is no guarantee that any forward-looking statements made in this communication will be attained.

P/M Tracking Number: 07072026-7504601.1.1