Stephen M. Mills, CIMA® Partner

Chief Investment Strategist

The U.S. financial markets continue to reward patient investors. Stocks, as measured by the popular benchmark S&P 500 Index, recorded a 15.3% total return in the first half of the year as of June 30, while the tech-heavy NASDAQ Index posted a gain of 14.5% after surging 44.6% in 2023.1 Both indices were primarily driven by large tech stocks that are investing heavily in artificial intelligence (AI) related solutions. AI has been the dominant theme for the stock market for the past 18 months. There is a great deal of investor optimism about significant efficiencies and productivity gains for many businesses from AI applications that could significantly enhance corporate profits over the next several years. Many strategists believe that AI could have a bigger impact on people’s lives in the future than the impact of smart phones and the internet has had over the past 25 years. We believe that we are in the very early stages of a ramp-up of the use of AI by both businesses and individuals over the next few years, that will positively impact many areas of our personal lives including healthcare, financial, travel, entertainment, and nutrition to name a few. We will explore more on this subject in future letters but for now, we wanted to point out how the growing use of AI is impacting the performance of the financial markets and investors pocket books.

U.S. Economy

Overall, the U.S. economy remains in a positive growth mode. GDP (Gross Domestic Product) estimates from many economists have the economy growing in the 2.0% to 2.5% range after inflation for the first half of 2024 after posting a 2.5% inflation adjusted increase in 2023.2 While recent economic data for employment, manufacturing, and consumer spending indicate a mild deceleration in economic growth, we believe the economy remains very resilient despite higher interest rates and an inflation rate that has remained stubbornly above 3%. Inflation has improved significantly since peaking at a 9% annualized rate in June of 2022 but still remains above the Federal Reserve’s target rate of 2%.

In our view, both consumers and business continue to suffer from the lag effect of higher-than-normal inflation. Higher costs for things like groceries, restaurant meals, auto and property insurance coverage, healthcare, and energy are straining consumers pocketbooks. Inflation tends to dampen demand for goods and services which we believe is being reflected currently in economic data such as weaker retail sales, increased credit card debt and delinquencies, and a slowdown in home and automobile sales and other durable goods. Yet despite this weakness, the overall economy remains resilient and continues to grow modestly.

With the recent deceleration of economic growth, many economists believe that the Federal Reserve (Fed) could begin lowering interest rates soon. Back in the fourth quarter of 2023, the Fed halted further rate increases and indicated at the November FOMC meeting that it could begin lowering the Fed funds rate sometime in 2024. The Fed raised the Fed funds rate by a total of 5.25% from March 2022 to July 2023 and it currently sits at 5.5%.3 At the beginning of this year, many economists and market strategists were projecting as many as six Fed rate-cuts totaling about 1.5% in 2024. However, when inflation statistics in the first half of the year began indicating that the decline in the inflation rate may have stalled out at around a 3% annualized rate, the Fed backed off its rate-cut talk. As a result, many economists and market strategists are now projecting only one or two rate-cuts for 2024.

We believe inflation will need to resume its downward trend toward the Fed’s 2% target rate before the Fed moves to lower interest rates. We wouldn’t be surprised if the Fed waited until after the November election to begin cutting rates. However, if the economy continues to weaken, the Fed may move sooner to stimulate economic activity. The Fed’s objective when it began tightening monetary policy in early 2022, was get inflation back down to its 2% target rate without hopefully causing a recession. Fed officials have been able to walk this tight rope thus far but time will tell if the Fed will be successful in achieving that objective.

Equities

In our January 2024 client letter, we projected more gains for stocks in 2024 after a strong 2023.4 In this letter, we pointed out that in our view, the key drivers for the continued rise in stocks were a continuation of declining inflation, a more accommodating Fed monetary policy that included possible rate-cuts in 2024, continued moderate economic growth, and most importantly, improving corporate earnings. Although we have yet to see Fed rate-cuts so far this year, many investors continue to anticipate the Fed cutting the Fed fund rate in the second half of the year. We believe this optimism regarding looser Fed monetary policy has motivated investors to put idle cash to work in the stock market which has helped to push the major stock averages to repeated all-time highs this year. In addition, first quarter corporate earnings registered an 8% year-over-year growth rate, better than the 4% analyst consensus estimate.5 We believe corporate earnings will continue to surprise to the upside for the rest of 2024. We see the possibility of a more favorable interest rate environment, coupled with strong earnings growth, potentially driving the major stock market averages higher over the next 6-12 months.

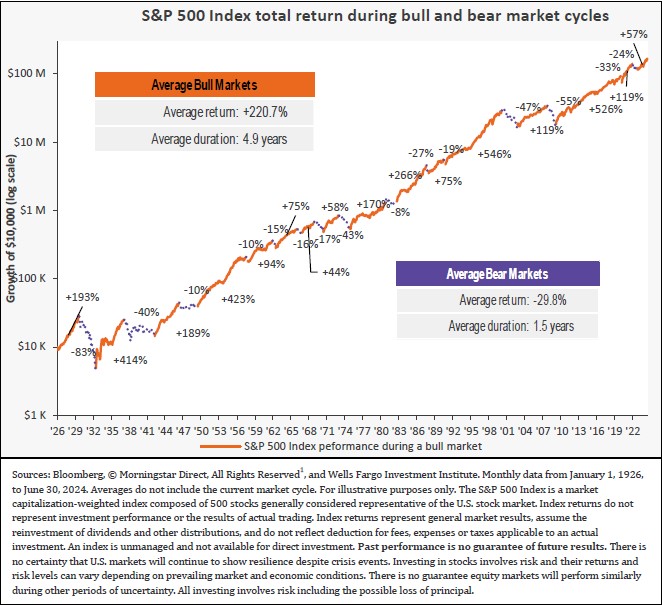

We believe that a new bull market in stocks began in the fall of 2022 when the S&P 500 Index bottomed out with a peak-to-trough decline of 24% from January 7, 2022 to October 13, 2022.1 From that October low, the S&P 500 has gained a total of 57% as of June 30, 2024, not including dividends.1 According to the chart, the average Bull market since January 1, 2026 has gained 220.7% and lasted 4.9 years while the average Bear market decline was 29.8% and lasted 1.5 years. While past performance is no guarantee of future results, we feel there is still gas in tank of this current bull market in stocks that could propel the major averages much higher. However, even in bull markets, corrections of 5% to 15% are normal. We experienced a 10% correction in the S&P 500 Index during this current bull market in 2023 from August 1 to the end of October.1 The S&P Index fell nearly 6% in April of this year as well.1 In both instances, stocks rallied and went on to make new all-time highs. It would not surprise us to see a 5-10% in the S&P index sometime between now and the end of the year. As we have stated in our previous letters, if such a correction were to occur, we recommend using it as a buying opportunity for those who are desiring to put cash to work in equities. Our favorite equity class continues to be high-quality U.S. large company stocks in the technology, industrial, consumer discretionary, and energy sectors. Small and mid-cap stocks continue to underperform as well as international and emerging market stocks. For investors seeking high dividend options, we favor utilities, selected real estate investment trusts, oil & gas pipeline stocks, and telecommunications stocks.

Fixed Income

As we mentioned earlier in this letter, several recent economic data points indicate that the economy is experiencing a mild growth deceleration. In our view, a slowing economy is a positive for fixed income investors. In our experience, a slowdown in economic activity tends to push interest rates lower and bond prices higher. We believe the decline in the 10-year U.S. Treasury Note yield from 4.7% in late April of this year to the current yield of 4.3%, is reflecting the possibility of continued economic weakness this year.1

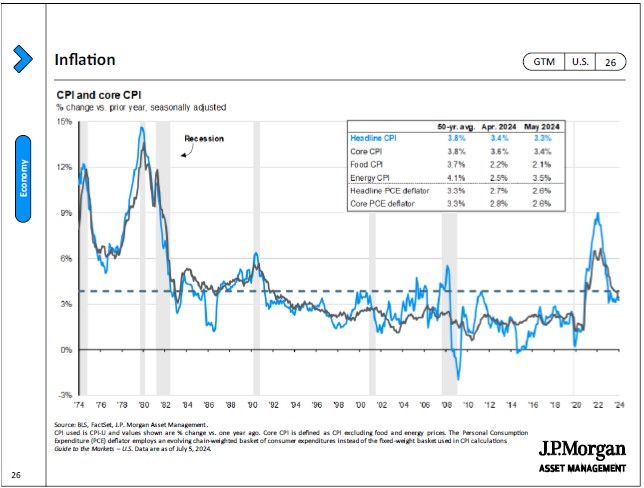

While economic activity can impact the bond market, another key driver of bond yields is inflation. The chart below shows the trend of CPI (Consumer Price Index) over the past 50 years and the most recent spike in 2022 where the CPI peaked out at 9% year-over-year (y/y). Since July 2022, the CPI has been trending lower with the latest reading in May coming at a y/y 3.3% increase. The Fed’s preferred gauge of inflation is the Personal Consumption Expenditures Deflator (PCED). After reaching 5.6% y/y in February 2022, the core PCED fell to 2.6% y/y in May of this year. If Core CPI and Core PCED continue their downward trend over the next 6-12 months, we could see the Fed cut the Fed funds rate 3-4 times over that time period. This would create a very favorable environment for fixed income investors, in our view. Although it is unclear as to when the Fed will begin cutting the Fed funds rate, we believe now is the time to begin moving cash into fixed income instruments, where appropriate. Over the past 18 months, prime money market mutual fund yields have topped 5%. With near risk-free yields that high, many investors saw little reason to lock up funds in longer maturity fixed income investments. However, if economic conditions allow the Fed to lower the Fed funds rate over the next few quarters, we believe money both market yields and bond yields will likely follow suit.

We continue to favor adding funds to fixed income instruments like high-grade corporate or municipal bonds with maturities in the 10-to-15-year range as well as U.S. Treasury securities with maturities in the 5-to-10-year range. We also favor high-grade mortgage-backed securities with yields in the 5-6% range at current levels.1

Strategy

We believe the positive equity market performance this year is reflecting a favorable economic environment that typically leads to positive performance. We currently have relatively low inflation, only moderately restrictive interest rates for business and consumers, and moderate economic growth. In such an environment, both stocks and bonds should perform reasonably well. We believe even at current valuation levels with the major indices at all-time highs, stocks can still achieve an annualized rate of return in the 8-10% range and bonds can provide investors with stable income in the 4-5% range over the next few years. (Forecasts, targets, and estimates are based on certain assumptions and our current views of the market and economic conditions, which are subject to change.)

We recommend that most investors diversity their portfolios by balancing between stocks, bonds, and cash, where appropriate. This type of allocation helps to cushion downside risk when the stock market enters a correction or a bear market. This diversified approach also provides a source of funds to buy stocks when they become more attractively valued as they did in the fall of 2022 when the S&P 500 Index had fallen 24% from its highs. In such circumstances, investors can shift funds from bonds or cash into stocks, where appropriate. Currently, with the S&P 500 Index trading at the higher end its normal valuation range, investors who desire to lock in gains and reduce downside risk could shift funds out of stocks and into bonds and/or cash, particularly if their equity allocation has risen above their long-term strategic target level. For instance, for the investor that has a target allocation of 60% equities and 40% cash and bonds, and has seen their equity allocation rise to 65% or 70% due to the recent stock market rally, they could shift 5% to 10% out of equities and into either bonds or cash to bring their equity allocation back down to their strategic target percentage. We believe now may be a good time for investors to consider such an allocation shift.

Our guidance continues to remain focused on holding high-quality investments in equities, fixed income and cash equivalent instruments. In this current environment, we feel that investors are not being rewarded for venturing into more risky areas of the market. Economic uncertainty, geopolitical risks and the November elections could create near-term volatility in the financial markets and we believe portfolios that focus more on higher quality investments will fare better than ones that have significant allocations to riskier areas of the market. The key to handling volatility is to have a plan, be patient and stay focused on your long-term financial goals and objectives.

As always, we are very grateful for the confidence and trust you place in us and will continue to work diligently to provide you with the best service possible.

Your Trinity Capital Management Team

Tyler TX Location

821 ESE Loop 323, Suite 100

Tyler, Texas 75701

903-747-3960

Webite:www.tcmtx.com

Footnotes

1 Thompson One charts

2 Bureau of Economic Analysis U.S. Department of Commerce.https://www.bea.gov/

3 Forbes Advisor, “Federal Funds Rate History 1990-2024.” https://www.forbes.com/advisor/investing/fed-funds-rate-history/

4 https://www.tcmtx.com/blog/post/tcm-2024-investment-outlook-strategy-january-12-2024

5 Wells Fargo Investment Institute Economic and Market Commentary, June 10, 2024

To view the footnote links, press and hold the Ctrl key on your keyboard, hover over the link and left click your mouse.

Investment products and services are offered through Wells Fargo Advisors Financial Network, LLC (WFAFN), Member SIPC, a registered broker-dealer and separate non-bank affiliate of Wells Fargo and Company. Trinity Capital Management, LLC is separate entity from WFAFN.

Stocks offer long-term growth potential, but may fluctuate more and provide less current income than other investments. An investment in the stock market should be made with an understanding of the risks associated with common stocks, including market fluctuations. Investing in foreign securities presents certain risks not associated with domestic investments, such as currency fluctuation, political and economic instability, and different accounting standards. This may result in greater share price volatility.

The opinions expressed in this report are those of the author(s) and are not necessarily those of Wells Fargo Advisors Financial Network or its affiliates. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy.

Wells Fargo Advisors Financial Network is not a legal or tax advisor. Consult your tax advisor or accountant for more details regarding your specific circumstance.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income securities may be worth less than the original cost upon redemption or maturity. Yields and market value will fluctuate so that your investment, if sold prior to maturity, may be worth more or less than its original cost. Bond prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment. Income from municipal securities is generally free from federal taxes and state taxes for residents of the issuing state. While the interest income is tax-free, capital gains, if any, will be subject to taxes. Income for some investors may be subject to the federal Alternative Minimum Tax (AMT).

The commodities markets are considered speculative, carry substantial risks, and have experienced periods of extreme volatility. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns nor can diversification guarantee profits in a declining market.

The Consumer Price Index (CPI) is a measure of the cost of goods purchased by average U.S. household. It is calculated by the U.S. government's Bureau of Labor Statistics.

P/E Ratio is a valuation of a company or an index’s current value compared to its earnings per share. It is calculated by dividing the market value per share by earnings per share.

S&P 500 Index: The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index with each stock's weight in the Index proportionate to its market value.

Index return information is provided for illustrative purposes only. Index returns do not represent investment performance or the results of actual trading. Index returns reflect general market results, assume the reinvestment of dividends and other distributions and do not reflect deduction for fees, expenses or taxes applicable to an actual investment. An index is unmanaged and not available for direct investment.

Past performance is no guarantee of future results and there is no guarantee that any forward-looking statements made in this communication will be attained.

P/M Tracking Number: 01102026-6778211.1.1