Stephen M. Mills, CIMA® Partner

Chief Investment Strategist

As we turn the page on the third quarter of the year and move into what is likely to be a very interesting and eventful fourth quarter, stocks are at record highs, interest rates are trending lower, inflation is subsiding and the U.S. economy just keeps chugging along like the “Little Engine That Could.” Many investors are enjoying the second year in a row of double-digit gains in their stock portfolios as well as getting respectable annualized returns in the 4-5% range for high-quality bonds and cash equivalent investments.1As one of the lines in Andrew Lloyd Webber’s Broadway musical, Whistle Down the Wind goes, “It just doesn’t get any better than this.”

Global stock markets continue to show strength despite the growing instability in the Middle East, the ongoing war of attrition in Ukraine, mixed U.S. economic data and perhaps the strangest U.S. presidential election in history. Through all of this uncertainty, the S&P 500 Index has made 44 new all-time highs this year, as of the date of writing.1

In our view, one word describes the U.S. stock market: resilient. It seems like no matter what negative news gets thrown at investors, the market continues to march higher. Of course, there have been a few bumps in the road so far this year like the unwinding of the Japanese yen carry trade in August that led to a 6% drop in the S&P 500 over four trading days and the 4% decline in the S&P 500 in early September following a weaker than expected employment report. But, for the most part, the stock market has been remarkably strong in the face of numerous headwinds.

As we stated in our July 2024 letter, we believe stocks are in a bull market trend that started in the fall of 2022 when the S&P 500 bottomed out after a peak-to-trough decline of 24% from January 7, 2022 to October 13, 2022.2From that October low, the S&P 500 has risen by a total of 57%, as of September 30 (not including dividends).1We believe the Federal Reserve added fuel to the bull market fire in September when it moved to lower the benchmark Fed funds rate by .5% at its FOMC meeting.3This move signaled a change in the direction of Fed monetary policy from neutral to easing. The Fed had raised the Fed funds rate from nearly zero in January 2022 to 5.5% by July 2023, at which time they paused further rate-hikes. In November 2023, the Fed signaled the possibility of rate-cuts in 2024 if the inflation statistics continued to trend lower. However, the Fed waited until September to make its first cut after seeing enough evidence that inflation was continuing to move toward its 2% target rate and economic growth was moderating. Federal Reserve Chairman Jerome Powell indicated in the September FOMC post-meeting press conference, that the Fed would continue to carefully assess incoming data for both inflation and economic growth in considering additional rate adjustments.3According to the Fed’s own forecast for interest rates, they anticipate the possibility of an additional 50 basis points (.5%) of rate cuts through the rest of 2024 with an additional 100 basis points (1%) of cuts in 2025.4

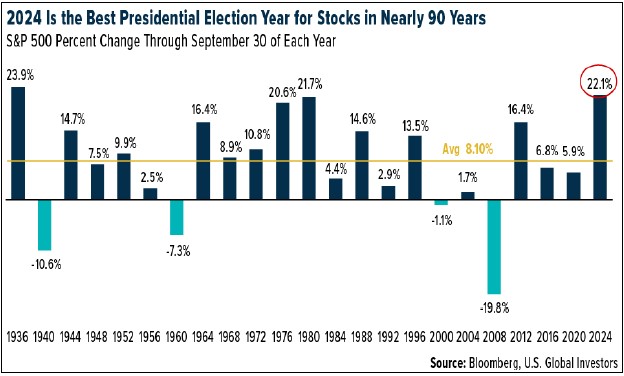

While the potential for interest rates to decline is positive for the stock market, we believe corporate earnings have been the key driver of stocks prices so far this year. According to FactSet’s Earnings Insight report as of September 27, the third quarter of 2024 will mark the fifth straight quarter of year-over-year earnings growth for the S&P 500.5We feel the consistency of this earnings growth has helped to fuel the S&P 500 Index to a 22.1% total return for the first nine months of the year. In addition, the widely followed Dow Jones Industrial Average has posted a double-digit gain this year with a total return of 14%, as of September 30.1

Based on investment industry analysts’ estimates, S&P 500 earnings for 2024 are projected to come in at about $240 per share, a 10% increase from 2023.6Wells Fargo Investment Institute is projecting S&P 500 earnings to hit $260 per share in 2025, indicating the potential for another strong year for earnings growth. We believe this strong earnings growth will continue to be a positive catalyst for stocks over the next 12-18 months.7

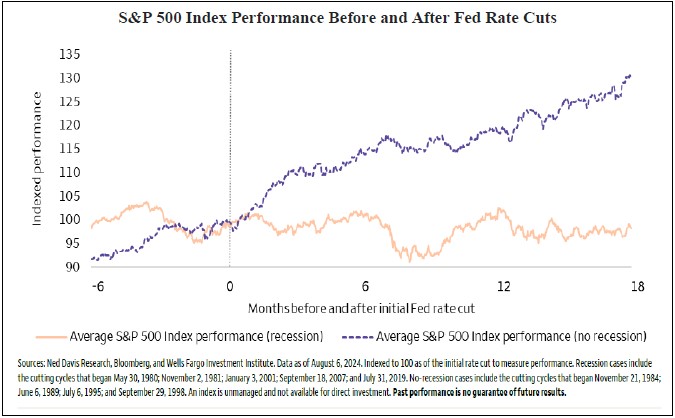

The Fed’s easing of monetary conditions could also be a strong tail wind for the stock market going forward. The Fed’s initiation of rate cuts in September has historically been very positive for stocks when a rate cut did not correspond with a recession for the U.S. economy. According to the chart below, since 1974, when the Fed cut rates and there was no recession, the S&P 500 Index rose on average 30% over the next eighteen months. However, when the cuts corresponded with a recession, the S&P 500 Index performance was choppy before ending mostly flat for the period.

We believe this easing of monetary conditions will help support U.S. economic growth over the next 12-18 months as interest rates for things like home mortgage loans, auto loans, installment notes, and credit cards potentially move lower. Recent economic data has been mixed with manufacturing data showing weakness but consumer spending holding up well. The most recent jobs report for September showed that the U.S. economy added 254,000 jobs, well above consensus estimates and the strongest in six months.7We believe U.S. consumer finances are still in pretty good shape which could continue to support spending, especially as we get into the holiday season. Since consumer spending accounts for two-thirds of U.S. GDP, we believe the U.S. economy will continue to grow moderately for the next several quarters.

However, there are a couple of near-term risks to our somewhat rosy picture for the economy and the stock market. Topping the list is the war in the Middle East between Israel and the Iranian proxies Hamas and Hezbollah. Continued escalation of hostilities between Israel and Iran poses a risk to oil supplies in the region. Oil prices have risen significantly over the past two weeks as investors grow more concerned about a disruption in Iran’s oil production as well as the possibility that Iran could attempt to close the Strait of Hormuz where one-fifth of the world’s oil supply passes daily. Higher oil prices, if sustained for several months, would potentially have a negative impact on both inflation and global economic growth. While we believe neither Israel or Iran desire to see the conflict escalate much further, this remains a risk factor for the financial markets in the short-term. In addition, we continue to worry about the war in Ukraine escalating and becoming regional, as neither side seems to be interested in negotiating peace. The longer the war goes on, the greater the risk of escalation, in our view.

We believe the other significant near-term risk factor is the upcoming U.S. elections. A close presidential election could result in voter recounts in key closely contested states which could take days or even weeks to resolve. The uncertainty in the interim could create volatility in the financial markets. As far as the intermediate term impact of the election on the economy and the equity markets, we believe the most likely outcome will be a divided government with neither major party having control of the White House as well as both Houses of Congress. In our view, such an outcome would mean continued gridlock in Washington making it difficult for either party to implement much of its agenda. Even if one party does manage to gain control of both the executive and legislative branches of government, it would most likely have very narrow control of the legislative branch making it difficult for the party in control to pass legislation involving taxes or spending without the other party’s help. The bottom line is, we believe the election outcome will not have a meaningful negative impact on either the U.S. economy or the financial markets for 2025.

So far, this election year has been exceptionally strong. Election years often bring volatility, especially prior to the election as investors wrestle with the uncertainty surrounding a potential leadership change in Washington. With the added uncertainty around this year’s presidential election, one would have thought the stock market would have sold off significantly by now. However, despite two assassination attempts on President Trump’s life, and a last-minute change at the top of the Democratic ticket, investors have shrugged off these events and continue to push the stock market higher.

So far, this election year is shaping up to be the best presidential election year for stocks in nearly 90 years. As you can see in the chart above, by the end of September, the S&P 500 Index had posted a total return of more than 22%, the highest return during an election year since 1936.8In our view, strong corporate earnings and the Fed’s shift to a looser monetary policy has kept market sentiment buoyant despite the uncertain political backdrop.

In summary, we continue remain bullish on stocks. However, stocks don’t go straight up and there are always corrections along the way. It would not surprise us to see a 5-10% correction in the overall stock market at some point in the next few quarters, perhaps even before the end of the year. If the presidential election results are unclear for an extended period of time after election day, we believe this could be potentially negative for stocks in the short-term. We would use any correction in stocks as an opportunity to add to equity exposure, where appropriate. We continue to focus primarily on high-quality large company stocks, high-grade fixed income instruments and cash type marketable securities like prime money funds. We see opportunities especially in the energy and commodity sectors that have lagged behind the rest of the stock market this year. In addition, we continue to like technology, healthcare, and consumer discretionary stocks. We continue to shy away from adding to small cap and international equities at this time. At some point in this bull market cycle, we believe these asset classes will become more attractive. However, we will be patient and wait for fundamentals to improve before committing funds.

We have always believed that uncertainty often presents opportunity. We believe now is the time to be making preparations to take advantage of any market volatility around the election or possibly an increase in geopolitical risks. Once the election is settled and investors know who will be occupying the White House and what the makeup of Congress looks like, we feel 2025 could be another good year for the financial markets.

As always, we are very grateful for the confidence and trust you place in us and will continue to work diligently to keep you informed and seek to provide you with outstanding service.

Your Trinity Capital Management Team

Tyler TX Location

821 ESE Loop 323, Suite 100

Tyler, Texas 75701

903-747-3960

Webite:www.tcmtx.com

Footnotes

1 Thompson One charts

2 TCM Investment Outlook & Strategy, July 2024

3 Wells Fargo Investment Institute, FOMC Meeting: Key Takeaways, September 18, 2024

4 Riverfront Investment Group, Fed Rate Cutting Cycle Begins with a Bang, September 24, 2024.

5 FactSet Earnings Insight, September 27, 2024. https://www.factset.com/earningsinsight

6 U.S. Bank Wealth Management, “Investors Focus Attention on Corporate Earnings.” September 4, 2024

7 Wells Fargo Investment Institute, 2024 Midyear Outlook, June 2024

8 Bureau of Labor Statistics U.S. Department of Labor Employment Report, October 4, 2024. https://www.bls.gov/news.release/pdf/empsit.pdf

9 U.S Global Investors, October 7, 2024.

To view the footnote links, press and hold the Ctrl key on your keyboard, hover over the link and left click your mouse.

Investment products and services are offered through Wells Fargo Advisors Financial Network, LLC (WFAFN), Member SIPC, a registered broker-dealer and separate non-bank affiliate of Wells Fargo and Company. Trinity Capital Management, LLC is separate entity from WFAFN.

Stocks offer long-term growth potential, but may fluctuate more and provide less current income than other investments. An investment in the stock market should be made with an understanding of the risks associated with common stocks, including market fluctuations. Investing in foreign securities presents certain risks not associated with domestic investments, such as currency fluctuation, political and economic instability, and different accounting standards. This may result in greater share price volatility.

The opinions expressed in this report are those of the author(s) and are not necessarily those of Wells Fargo Advisors Financial Network or its affiliates. The material has been prepared or is distributed solely for information purposes and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy.

Wells Fargo Advisors Financial Network is not a legal or tax advisor. Consult your tax advisor or accountant for more details regarding your specific circumstance.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income securities may be worth less than the original cost upon redemption or maturity. Yields and market value will fluctuate so that your investment, if sold prior to maturity, may be worth more or less than its original cost. Bond prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment. Income from municipal securities is generally free from federal taxes and state taxes for residents of the issuing state. While the interest income is tax-free, capital gains, if any, will be subject to taxes. Income for some investors may be subject to the federal Alternative Minimum Tax (AMT).

The commodities markets are considered speculative, carry substantial risks, and have experienced periods of extreme volatility. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Asset allocation cannot eliminate the risk of fluctuating prices and uncertain returns nor can diversification guarantee profits in a declining market.

The Consumer Price Index (CPI) is a measure of the cost of goods purchased by average U.S. household. It is calculated by the U.S. government's Bureau of Labor Statistics.

S&P 500 Index: The S&P 500 Index consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market value weighted index with each stock's weight in the Index proportionate to its market value.

Index return information is provided for illustrative purposes only. Index returns do not represent investment performance or the results of actual trading. Index returns reflect general market results, assume the reinvestment of dividends and other distributions and do not reflect deduction for fees, expenses or taxes applicable to an actual investment. An index is unmanaged and not available for direct investment.

Past performance is no guarantee of future results and there is no guarantee that any forward-looking statements made in this communication will be attained.

Compliance Tracking Number: PM-04102026-7175466.1.1